Unlocking Value in Programmatic Advertising: The Investment Case for Alkimi Exchange

7 minute read

This report is for informational purposes only and should not be construed as investment advice. Funds managed by Factor6 Capital, LP hold positions in Alkimi Exchange and may benefit from price movements of the $ADS token. This report does not constitute an offer or solicitation to buy or sell securities. See full disclaimer at the end of this report

Executive Summary

We believe Alkimi Exchange has the potential to significantly disrupt the programmatic advertising market

through the power of blockchain. Our investment in $ADS1 tokens reflects our high conviction, and we

share the pillars of our thesis:

- Competitive Advantage: The programmatic ad market is clunky, opaque, and burdened by high fees for both buyers (advertisers) and seller (publishers). The process runs through intermediaries, wherein $1 in ad spend results in only $0.51 to the publisher2. Alkimi’s custom, EVM-compatible smart contract platform directly connects advertisers and publishers, eliminating the need for most intermediaries and increasing revenue for both parties. The result is more ad impressions (CPMs, or cost per one thousand impressions) for buyers, and more net revenue for publishers.

- Growth Potential: Programmatic ad spend continues to grow at a feverish pace, with estimates projecting a total addressable market (TAM) of $738 billion by 20283. As a proxy for this growth, Google has seen digital ad revenue grow at an ~18% CAGR, increasing $28 billion to $238 billion from 2010-20234, while The Trade Desk, a leading demand-side platform, has achieved a CAGR of 33.5%, growing its revenue from $45 million to $2.1 billion over the past decade5.

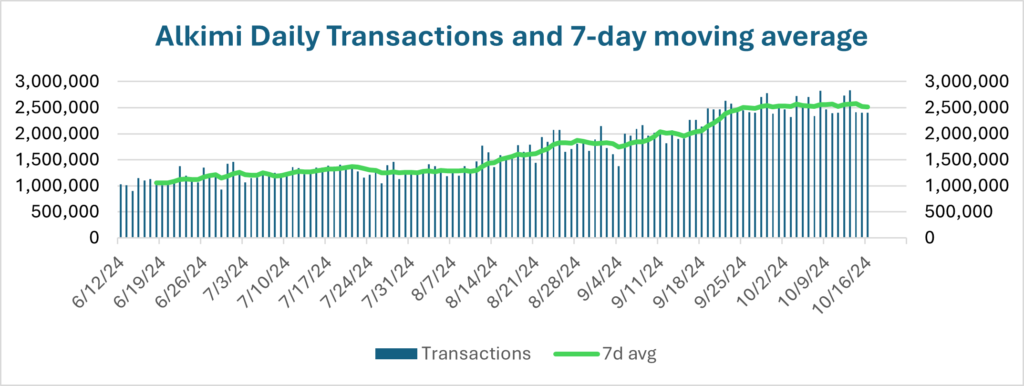

- The Time is Now: We believe Alkimi is nearing escape velocity in its growth trajectory, as demonstrated by the recent onboarding of high-profile advertisers and publishers, leading to rapid transaction growth. The seasonally strong 4Q to 1Q advertising periods, fueled by key retail events, are likely to further accelerate this momentum. Looking ahead, Alkimi’s expanding team of 65 employees, including a dedicated sales team of four, is consistently achieving milestones at an increasing pace, positioning the company for continued success.

- Revenue Model: Alkimi’s favorable tokenomics, where staked validators earn 100% of net protocol revenues, offer a clear path to value accrual to the $ADS token. Mechanically, fiat revenues are converted into tokens through buybacks and then distributed to validators. Additionally, Alkimi’s near-fully circulating supply significantly reduces the pressure from token emissions, further supporting token value stability.

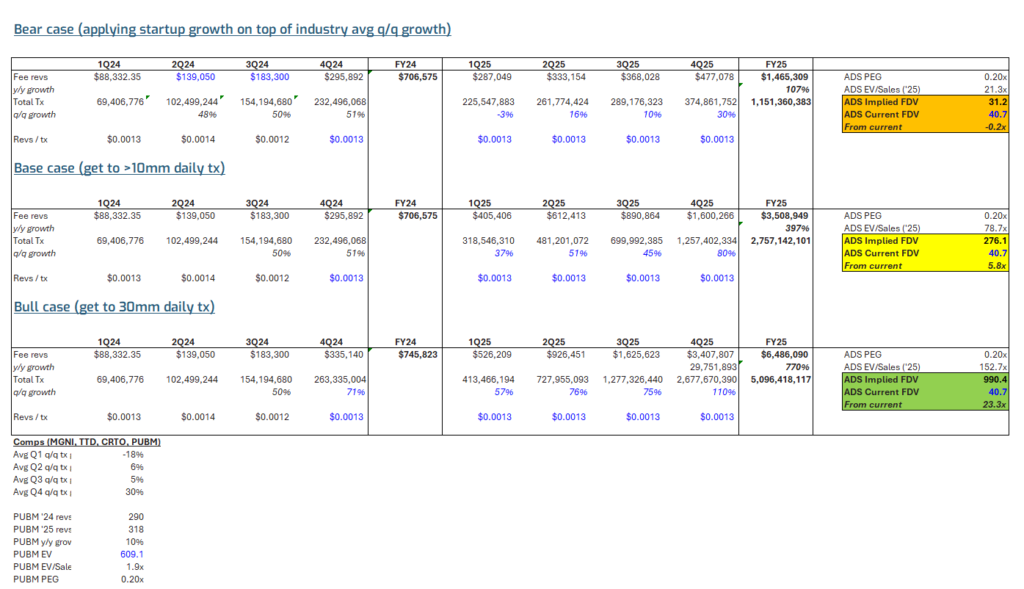

- Attractive Valuation: We believe Alkimi’s current valuation presents a compelling opportunity. In our base case, incorporating industry-average growth rates with Alkimi’s current trajectory, we estimate fee revenue of ~$3.5 million by 2025. Conservatively applying public equity comparable multiples (0.2x PEG) yields an implied market cap of ~$277 million, or roughly 5x the current price. In a reasonable bull case, significant expansion across both European and U.S. markets could drive daily transactions to ~30 million, resulting in ~$6.5 million in protocol revenue by 2025. Using the same multiples, this would imply a market cap exceeding $1 billion, or more than 20x current levels.

Background: The Programmatic Supply Chain

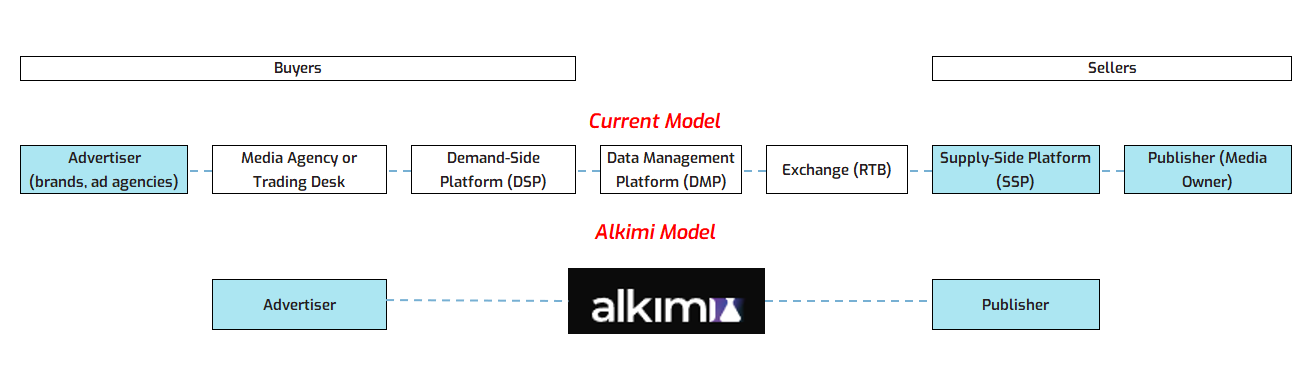

The programmatic ad market is one of the most significant developments in digital advertising over the past decade. Each time you visit a website and see an ad tailored to your interests, you’re witnessing the result of an ultrafast, automated process. This process is driven by a network of advertisers (e.g. Coco-Cola or Walmart), publishers (e.g. websites, mobile apps, video platforms), and intermediaries, such as demand-side platforms (DSPs), supply-side platforms (SSPs), and data management platforms (DMPs). These platforms work together to deliver personalized ads through the real-time bidding (RTB) process which happens on ad exchanges. Ad exchanges facilitate the meeting of buyers and sellers and handle millions of auctions per second.

However, the market’s complexity has introduced significant inefficiencies and costs. Each layer in the programmatic supply chain takes a cut. A 2020 ISBA report found that publishers may receive only $0.49 of every $1 spent by advertisers due to the number of intermediaries involved. Additionally, the system lacks transparency, making it difficult for advertisers and publishers to detect fraudulent activity such as domain spoofing, impression fraud, click fraud, pixel stuffing, and click fraud.

Figure 1: The Programmatic Supply Chain

Alkimi Exchange: A New Challenger

Founded in 2021 by advertising veterans Ben Putley (CEO) and Adam Chorley (COO), and CTO Chandru N., Alkimi Exchange was built to address these inefficiencies using blockchain technology. Launched in 2023, Alkimi’s custom Layer-2, EVM-compatible chain connects advertisers (through DSPs) directly with publishers (through SSPs) and integrates seamlessly with existing platforms using open-source protocols like OpenRTB and Prebid.

Alkimi’s decentralized architecture enables a more transparent, cost-efficient ad exchange. Unlike traditional centralized servers, Alkimi’s network of validators ensures that ad transactions are visible, auditable, and secure. Validators stake $ADS tokens as collateral in exchange for a share of the revenues generated by the protocol, providing further incentive for network participation.

Advantages

Dramatically Lower Fees: Alkimi charges a modest 3-5% fee compared to traditional players’ collective 49% take rate, enabling advertisers to gain more ad impressions and publishers to retain more revenue.

Increased Transparency: Alkimi’s decentralized network enables fully auditable transactions, reducing fraud and enhancing visibility into auction dynamics. Users can query the blockchain via API or browser, providing valuable insights into trading activity, including which bids passed or failed and at what prices.

Better User Experience: By cutting down on excess queries, auctions, and fraudulent activities like URL spoofing and click farming, Alkimi enhances both the advertiser and user experience.

Token Value Accrual: Tokenholders who become validators earn 100% of net revenue, after operating expenses, similar to a dividend. This creates a strong incentive to participate in and support the network. Mechanically, fiat revenue from advertisers and publishers is converted into tokens through buybacks, which are then distributed to validators. This model is further strengthened by the fact that $ADS has a near-fully circulating supply, distinguishing it from typical “rewards” tokens. Unlike designs where tokens are converted into fiat by holders, Alkimi’s structure directs flows in the opposite direction, enhancing long-term value accrual for tokenholders; this is an extremely important distinction, in our view.

Why Now?

Alkimi is hitting key milestones in its growth journey, as evidenced by significant transaction growth and the successful onboarding of new publishers and advertisers. Notable onboarding wins include AWS, Coca-Cola, Meta, Dyson, and Patek Philippe on the advertiser side, while the most notable publishers include The Telegraph, Evening Standard, Paramount, Warner Bros. Discovery, Daily Mail, and Condé Nast.

The $ADS token, with a fully diluted valuation of $41 million as of this writing, offers asymmetric upside. Favorable tokenomics—about 95% of token supply is already circulating—further de-risk the investment, in our view.

Looking ahead, we believe Alkimi is well-positioned to capitalize on the seasonally strong fourth quarter, driven by increased advertising demand during back-to-school and holiday campaigns. When comparing to public adtech companies like PubMatic, Magnite, The Trade Desk, and Criteo, we observe that the ad market typically sees a 25% revenue boost in Q4 compared to Q1-Q3 averages—a trend we expect Alkimi to leverage6. Additionally, we anticipate Alkimi will ramp up its U.S. expansion efforts in the coming months.

Figure 2: Recent new onboards to the Alkimi platform

Valuation

Below, we outline our valuation framework, which extrapolates future transaction growth based on Alkimi’s current trajectory and assumes an acceleration in onboarding both advertisers and publishers. Through 3Q24, transaction activity on Alkimi has impressively grown at a 50% quarter-over-quarter cadence.

Figure 3: Alkimi Daily Transactions7

Our base case assumes Alkimi continues this average growth rate, reaching over 10 million daily transactions through a combination of organic and inorganic growth, primarily in Europe. Using public adtech peer PubMatic, Inc. (Nasdaq: PUBM) as a benchmark, we apply its PEG ratio of 0.20x to $ADS, translating to a fully diluted valuation of ~$275 million or ~6.7x from current prices.

In our bull case, Alkimi experiences significant adoption from new market entrants, likely driven by a successful U.S. expansion, which could push the platform to 30 million daily transactions. Under this scenario, we project a fully diluted valuation of ~$1 billion or ~24x from current prices.

Our bear case assumes that while revenues continue to grow, transaction growth slows, remaining flat in Q1-Q3 before the seasonal Q4 ramp. In this scenario, the valuation could remain at current levels, with a potential downside of up to -30%.

Hypothetical Scenarios

Figure 4: Hypothetical Scenarios (Source: Factor6 Capital, LP research)

Disclaimer: The scenarios and projections presented in this report are hypothetical and based on assumptions that may not materialize. These assumptions include transaction growth, market expansion, and favorable economic conditions. Actual results could differ materially due to unforeseen events or risks. These are not predictions or guarantees of future performance.

Conclusion:

In our view, Alkimi Exchange offers a compelling investment opportunity, leveraging blockchain technology to revolutionize the programmatic ad market. By addressing the high costs and inefficiencies that have long plagued the industry, Alkimi is poised to disrupt a several hundred billion dollar sector. Its decentralized architecture not only cuts fees and enhances transparency but also provides strong value accrual to the $ADS token. Early, but encouraging, adoption by both publishers and advertisers underscores Alkimi’s market potential. Even with conservative assumptions about transaction growth and market share capture, we believe Alkimi offers asymmetric upside to its current valuation, and is one of the most compelling real-world use cases that we’ve come across in the Web3 space.

Risks to Our Thesis

As with any emerging technology, blockchain projects come with inherent risks:

· Competitive Risks: Incumbents may eventually lower their take rates to compete with Alkimi, but we view this as a long-term possibility. If it happens, it would signal recognition of Alkimi’s success and disruption in the market.

· Execution Risk: The primary challenge lies in onboarding new clients. Some advertisers may be hesitant to adopt new technology, especially in an industry that resists change due to entrenched high take rates. However, this resistance is precisely where the opportunity for disruption exists.

· Macro Risk: While not our base case, a macroeconomic slowdown could pressure ad spend, as advertising budgets tend to be closely tied to GDP growth. That said, we believe the overall market is large enough, and Alkimi has a clear path to capturing market share in a variety of economic conditions.

Footnotes

1 $ADS token contract address: 0x3106a0a076bedae847652f42ef07fd58589e001f on Ethereum, not to be confused with other ADS symbols.

2 Source: SBA Programmatic Supply Chain Transparency Study, Executive Summary. December 2020. https://www.isba.org.uk/system/files/media/documents/2020-12/executive-summary-programmatic-supply-chain-transparency-study.pdf

3 Source: Global programmatic advertising spending from 2017 to 2028. https://www.statista.com/statistics/275806/programmatic-spending-worldwide/

4 Source: Google

5 Source: The Trade Desk

6 Source: Factor6 Capital research

7 Source: Ads Explorer, Alkimi Labs. https://labs.alkimi.org/ads-explorer

Disclaimer

This report has been prepared by Factor6 Capital, LP (“Factor6”) for informational purposes only and should not be relied upon as investment, legal, tax, or other advice. The views expressed herein are solely those of Factor6 and do not necessarily reflect the views of any portfolio companies mentioned or other third parties. Factor6 has obtained certain information from third-party sources, including portfolio companies, believed to be reliable. However, Factor6 makes no representations or warranties as to the accuracy or completeness of the information, and such information may be outdated or superseded.

No Investment Recommendation or Solicitation: This report does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment products, nor should it be construed as a recommendation for any investment decision. This report is not an offer to invest in any fund managed by Factor6, and no such offer or solicitation will be made except by means of a confidential private placement memorandum (“PPM”), subscription agreement, and other definitive offering documents, which will only be provided to qualified investors. Any references to securities or portfolio investments are for illustrative purposes only and are not representative of all investments made by Factor6. Past performance is not indicative of future results, and there is no guarantee that future investments will yield similar results. Factor6 does not intend to update any forward-looking statements or projections contained herein, and actual results may differ significantly.

High Degree of Risk: Investments in any Factor6 fund entail a high degree of risk, including the risk of loss of capital. There is no assurance that a fund’s investment objective will be achieved, and investors should not rely on any projections or forecasts. Before making an investment decision, prospective investors should carefully review the fund’s PPM, subscription documents, and related materials, and consult their own legal, tax, and financial advisors.

Suitability of Investment: The investments discussed in this report may not be suitable for all investors, and no representations are made regarding the suitability of any investment for any particular person or entity. Potential investors should evaluate each investment in light of their own objectives, risk tolerance, and financial circumstances.

External Sources & Third-Party Links: Certain information contained in this report may include data obtained from third-party sources or may include links to external websites. Factor6 has not independently verified such information and provides no assurances as to its accuracy or completeness. Links to third-party websites are provided solely for convenience and do not constitute an endorsement of the content on such websites or their operators.

Timeliness & Accuracy of Information: The information contained in this report is as of the date of publication and is subject to change without notice. Factor6 undertakes no obligation to update any information, including opinions, projections, or forward-looking statements contained herein. Market conditions, security prices, and other variables may change and significantly impact the information contained in this report.

Position Disclosure & No Obligation to Update: Factor6 may hold positions in the securities or assets discussed in this report. However, Factor6 is under no obligation to update this report or publicly disclose any changes in those positions. The information contained herein is provided as of the publication date and may change due to market conditions or other factors.

No Reliance on Forward-Looking Statements: This report may contain forward-looking statements, including but not limited to, projections, forecasts, or estimates. These forward-looking statements are inherently uncertain and subject to risks that could cause actual outcomes to differ materially from those expressed or implied. Factor6 disclaims any obligation to update or revise such statements and urges readers not to place undue reliance on them.

Conflicts of Interest: Factor6 has established, maintains, and enforces policies reasonably designed to identify and manage conflicts of interest that may arise from its investment activities. For more important disclosures, including information regarding Factor6’s investment portfolio and potential conflicts of interest, please refer to our disclosures available on our website.

Copyright/Proprietary Rights: This report and its contents are the property of Factor6 and may not be reproduced, distributed, or transmitted in any form without the prior written consent of Factor6. Unauthorized use may result in legal consequences.

Past Performance Disclaimer: Past performance is not indicative of future results, and you should not assume that future investments will be profitable or will match the performance of past investments. Factor6’s portfolio may evolve over time, and this report may not reflect the most recent investments or portfolio updates.