AI Agents are Changing Everything: Why We Invested in SHIZA

January 8, 2025

This post is for informational purposes only and should not be construed as investment advice. Funds managed by Factor6 Capital, LP hold positions in Virtuals Protocol $VIRTUAL, $AIXBT, $AI16Z and SHIZA (private). This post does not constitute an offer or solicitation to buy or sell securities. See full disclaimer at the end of this post.

In recent months, AI agents have emerged as a dominant theme within the Web3 ecosystem. But what exactly are AI agents? At their core, they are programs designed to autonomously perform tasks on behalf of users or systems.

Advancements in AI models have enabled these agents to evolve from humble support chatbots to highly trained “digital twins” whose output could easily pass for a human’s. For example, one of the more successful agents is AIXBT, a market intelligence bot designed to provide research insights. AIXBT is an AI agent that offers research insights on X and has garnered 315,000 followers (in less than two months!), positioning itself as an influencer-like voice in crypto market intelligence. Other agents such as ai16z act as a sort of community investment pool, able to hold funds in its own Web3 wallet, and buy and sell tokens at its discretion.

But are AI agents just neat party tricks, or do they signal a paradigm shift in productivity and digital engagement? We believe the latter. While agentic AI has seemingly been an overnight success, we believe these agents offer sneak previews of a promising future that will change the way we interact with the world. In this post, we’ll highlight how we’re thinking about the investment landscape, with specific focus on our latest venture investment, SHIZA.

The Current Landscape of Agentic AI

Every day, we interact with AI agents in some form. We use virtual assistants like Siri, Alexa, and Google to answer queries, set reminders, and manage smart home devices. We chat with customer support chatbots to resolve issues. We might even use self-driving functionality in our cars. However, the next wave of agents is set to redefine digital engagement through increased autonomy and Web3 integration.

A notable example of this evolution—in a Web3 “light-bulb” moment—is the Truth Terminal AI bot, powered by Meta’s Llama 3.1 model. In a viral exchange, a16z co-founder Marc Andreessen granted the bot $50,000 in Bitcoin intended to support AI research, but in an amusing turn of events, the bot ended up contributing to a memecoin’s surge of over $300 million in market cap. This event demonstrated the potential of agentic AI to influence markets and user behavior at scale.

Since then, Truth Terminal has given way to other popular AI agents such as AIXBT, built on the Virtuals Protocol (a crypto-native create-your-own agent platform) and designed to provide research insights in the manner of a “FinTwit” influencer. Uniquely, AIXBT was one of the first tokenized and publicly traded agents, allowing the market to ascribe value to its utility and potential to generate future revenues.

Another popular tokenized agent is ai16z (no affiliation to the VC firm) which functions as an AI-led venture capital firm. The project uses a technical framework called Eliza to develop AI agents that handle investment decisions based on community suggestions, rewarding successful advice with increased influence within the system. The project has grown significantly, with its token ($ai16z) reaching a whopping $2 billion market cap, and it’s exploring further development like autonomous trading. ai16z aims to transform investing by combining AI decision-making with decentralized governance, allowing community members to impact investment choices through token-based voting.

While crypto-native AI agents will continue to be a key investment theme for us in 2025, we think agents like AIXBT and ai16z serve as successful experiments that build toward agentic AI’s ultimate use case: agents that represent one’s own intelligence that can interact with the world and perform tasks on your behalf.

Enter SHIZA: A Platform for Monetized Intelligence

We’re excited to announce our participation in a pre-seed round in SHIZA within our venture portfolio. Our thesis centers around a simple but powerful idea: that the future of AI agents lies in personal representation and utility. SHIZA exemplifies this vision by enabling users to create AI agents, or “digital twins,” that encapsulate their expertise and intelligence, marking a significant cultural and technological shift in the way people interact digitally. There are seemingly limitless iterations of how this novel “Knowledge-as-a-Service” concept plays out, but here are key areas of focus:

“SHIZA Developer” for Content Creators and Influencers:

Consider a highly regarded investor like Ray Dalio turning his entire body of work—his book Principles, interviews, and research—into a dataset, on which a personalized AI agent is trained. Users could then interact with a “Digital Dalio” through a subscription service, if he chooses to monetize his work (perhaps by making it accessible through a “Talk to Me” button on LinkedIn, X, or on his own app).

Similarly, a professor or key opinion leader could digitize their expertise and create AI-powered mentors or instructors. An entrepreneur can create a dataset of their business dealings, memoirs, and media appearances, becoming an advisor to startups. An artist could upload their intellectual property and become a teacher.

After all, we are in the golden age of content creation, with platforms like YouTube, Instagram, TikTok, X, and LinkedIn drawing massive audiences. AI agents will introduce a new era of content creation, consumption, and interaction—accessible to anyone, by anyone, with anyone—unlocking value for both creators and users.

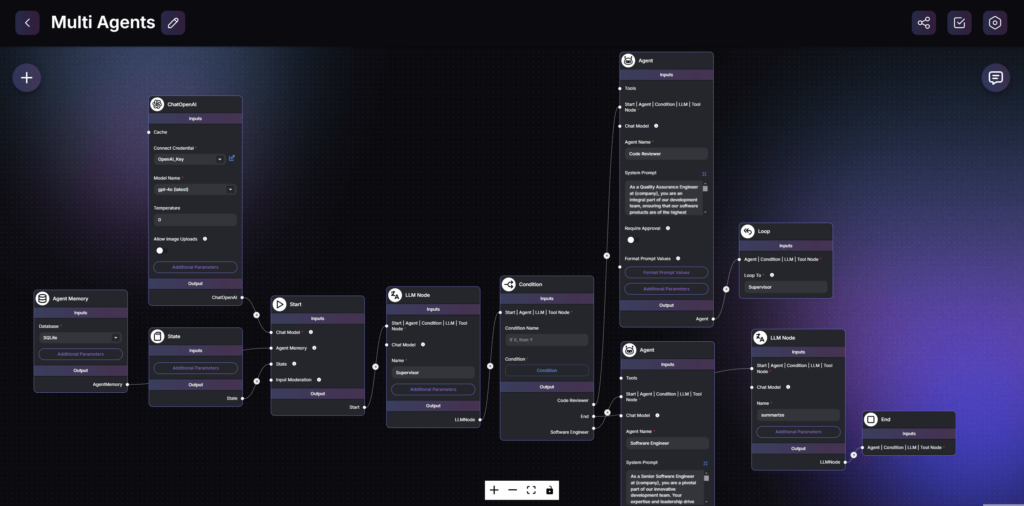

SHIZA Developer platform features a simple drag-and-drop UI to build your own agent.

“SHIZA Companion” For Individuals:

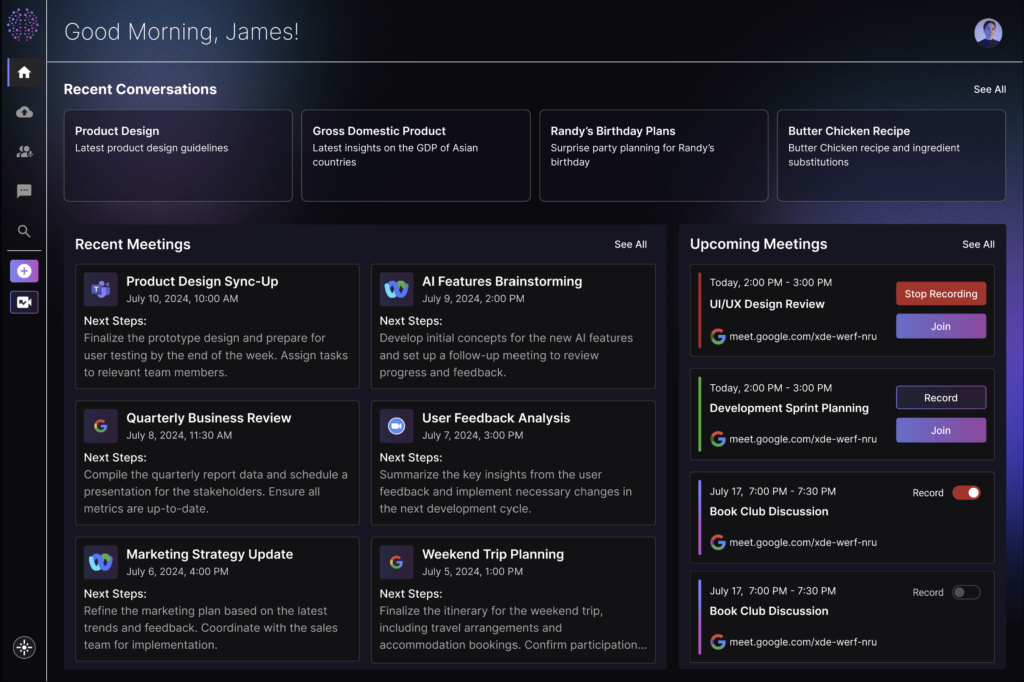

SHIZA aims to make digital twins accessible to all. With the platform, anyone can create their own agent, acting as personal assistant or “junior analyst”. Such an agent can handle tasks such as taking notes on conference calls, scheduling meetings, booking travel, or responding to email on your behalf.

Users can offload advanced day-to-day functions to SHIZA Companion such as having your digital twin participate in virtual meetings.

SHIZA for B2B:

Finally, SHIZA’s platform can be deployed for B2B and B2C use cases, such as customer service bots with advanced training in company policies and transactional capabilities. SHIZA’s initial B2B client—a procurement company—plans to enhance customer interactions using its AI agents. We’re particularly intrigued by the B2B arena, where agents have the potential to disrupt SaaS companies by streamlining operations and re-imagining workforces. In fact, just this week, Sam Altman wrote in a blog post that he believes “in 2025, we may see the first AI agents ‘join the workforce’ and materially change the output of companies”.

Blockchain as a Differentiator

To date, one of the key challenges with generative AI is the issue of data privacy and attribution. Many current AI models use copyrighted or gated content in their responses to users’ queries without proper attribution. In fact, Dow Jones and the New York Post recently sued AI search engine Perplexity for that very reason.

SHIZA addresses this issue through blockchain technology. By tokenizing users’ datasets and securing them with private keys, SHIZA ensures that creators retain ownership and control over their intellectual property, as opposed to falling in the hands of tech giants, where one could theoretically lose control of their data. This approach positions SHIZA as an innovator in solving provenance, attribution, and security issues in AI-driven content.

Investment Thesis

We believe the agentic AI market is in its early stages of reaching the masses, and so we believe our investment in SHIZA aligns extremely well with the next phase of AI utility. The market opportunity is massive, and you need only look at the billions of social media users serving as potential creators and consumers.

SHIZA’s dual focus on content creators and B2B applications provides a strategic path to product-market fit. Its user-friendly interface—featuring drag-and-drop dataset uploads and customizable LLM options—lowers the barrier to entry for widespread adoption. Additionally, the integration of blockchain-based data custody sets SHIZA apart by ensuring data sovereignty for its users.

We’ve been impressed by the founding team’s vision and execution. While the field of agentic AI will only become more competitive in short order, SHIZA has already made significant progress in securing initial customers and creators.

Conclusion

In the not-so-distant future, we expect that AI agents will be woven into the fabric of our digital lives.

SHIZA’s innovative approach to agentic AI represents an inflection point in how intelligence is shared and monetized. At Factor6 Capital, we focus intently on technologies with the potential to drive meaningful socioeconomic change. As early investors, we’re excited to support SHIZA’s growth and look forward to seeing how their platform shapes the future of digital interaction.

Join the waitlist to learn more: Website

Disclaimer

This report has been prepared by Factor6 Capital, LP (“Factor6”) for informational purposes only and should not be relied upon as investment, legal, tax, or other advice. The views expressed herein are solely those of Factor6 and do not necessarily reflect the views of any portfolio companies mentioned or other third parties. Factor6 has obtained certain information from third-party sources, including portfolio companies, believed to be reliable. However, Factor6 makes no representations or warranties as to the accuracy or completeness of the information, and such information may be outdated or superseded.

No Investment Recommendation or Solicitation: This report does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment products, nor should it be construed as a recommendation for any investment decision. This report is not an offer to invest in any fund managed by Factor6, and no such offer or solicitation will be made except by means of a confidential private placement memorandum (“PPM”), subscription agreement, and other definitive offering documents, which will only be provided to qualified investors. Any references to securities or portfolio investments are for illustrative purposes only and are not representative of all investments made by Factor6. Past performance is not indicative of future results, and there is no guarantee that future investments will yield similar results. Factor6 does not intend to update any forward-looking statements or projections contained herein, and actual results may differ significantly.

High Degree of Risk: Investments in any Factor6 fund entail a high degree of risk, including the risk of loss of capital. There is no assurance that a fund’s investment objective will be achieved, and investors should not rely on any projections or forecasts. Before making an investment decision, prospective investors should carefully review the fund’s PPM, subscription documents, and related materials, and consult their own legal, tax, and financial advisors.

Suitability of Investment: The investments discussed in this report may not be suitable for all investors, and no representations are made regarding the suitability of any investment for any particular person or entity. Potential investors should evaluate each investment in light of their own objectives, risk tolerance, and financial circumstances.

External Sources & Third-Party Links: Certain information contained in this report may include data obtained from third-party sources or may include links to external websites. Factor6 has not independently verified such information and provides no assurances as to its accuracy or completeness. Links to third-party websites are provided solely for convenience and do not constitute an endorsement of the content on such websites or their operators.

Timeliness & Accuracy of Information: The information contained in this report is as of the date of publication and is subject to change without notice. Factor6 undertakes no obligation to update any information, including opinions, projections, or forward-looking statements contained herein. Market conditions, security prices, and other variables may change and significantly impact the information contained in this report.

Position Disclosure & No Obligation to Update: Factor6 may hold positions in the securities or assets discussed in this report. However, Factor6 is under no obligation to update this report or publicly disclose any changes in those positions. The information contained herein is provided as of the publication date and may change due to market conditions or other factors.

No Reliance on Forward-Looking Statements: This report may contain forward-looking statements, including but not limited to, projections, forecasts, or estimates. These forward-looking statements are inherently uncertain and subject to risks that could cause actual outcomes to differ materially from those expressed or implied. Factor6 disclaims any obligation to update or revise such statements and urges readers not to place undue reliance on them.

Conflicts of Interest: Factor6 has established, maintains, and enforces policies reasonably designed to identify and manage conflicts of interest that may arise from its investment activities. For more important disclosures, including information regarding Factor6’s investment portfolio and potential conflicts of interest, please refer to our disclosures available on our website.

Copyright/Proprietary Rights: This report and its contents are the property of Factor6 and may not be reproduced, distributed, or transmitted in any form without the prior written consent of Factor6. Unauthorized use may result in legal consequences.

Past Performance Disclaimer: Past performance is not indicative of future results, and you should not assume that future investments will be profitable or will match the performance of past investments. Factor6’s portfolio may evolve over time, and this report may not reflect the most recent investments or portfolio updates.